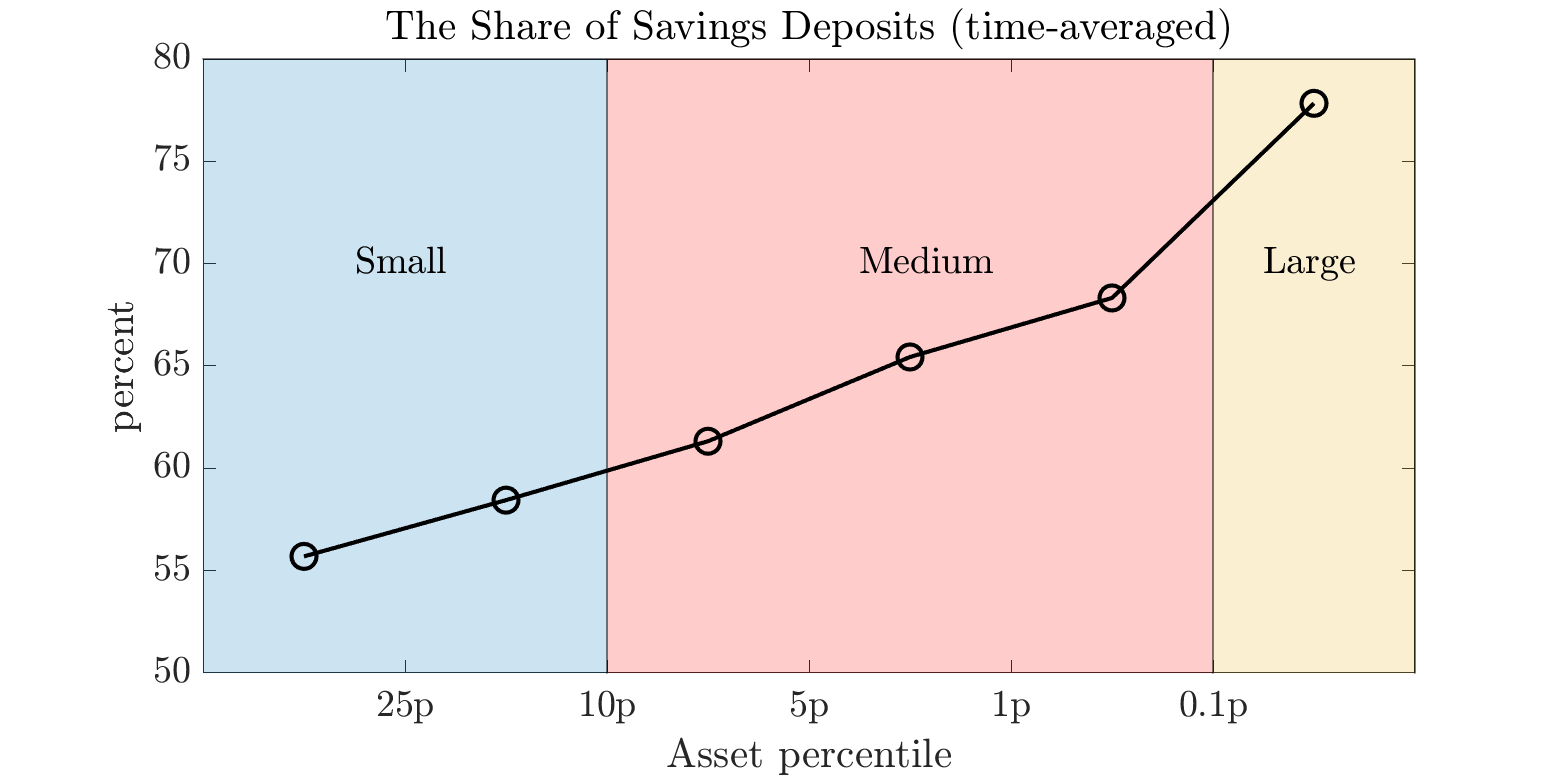

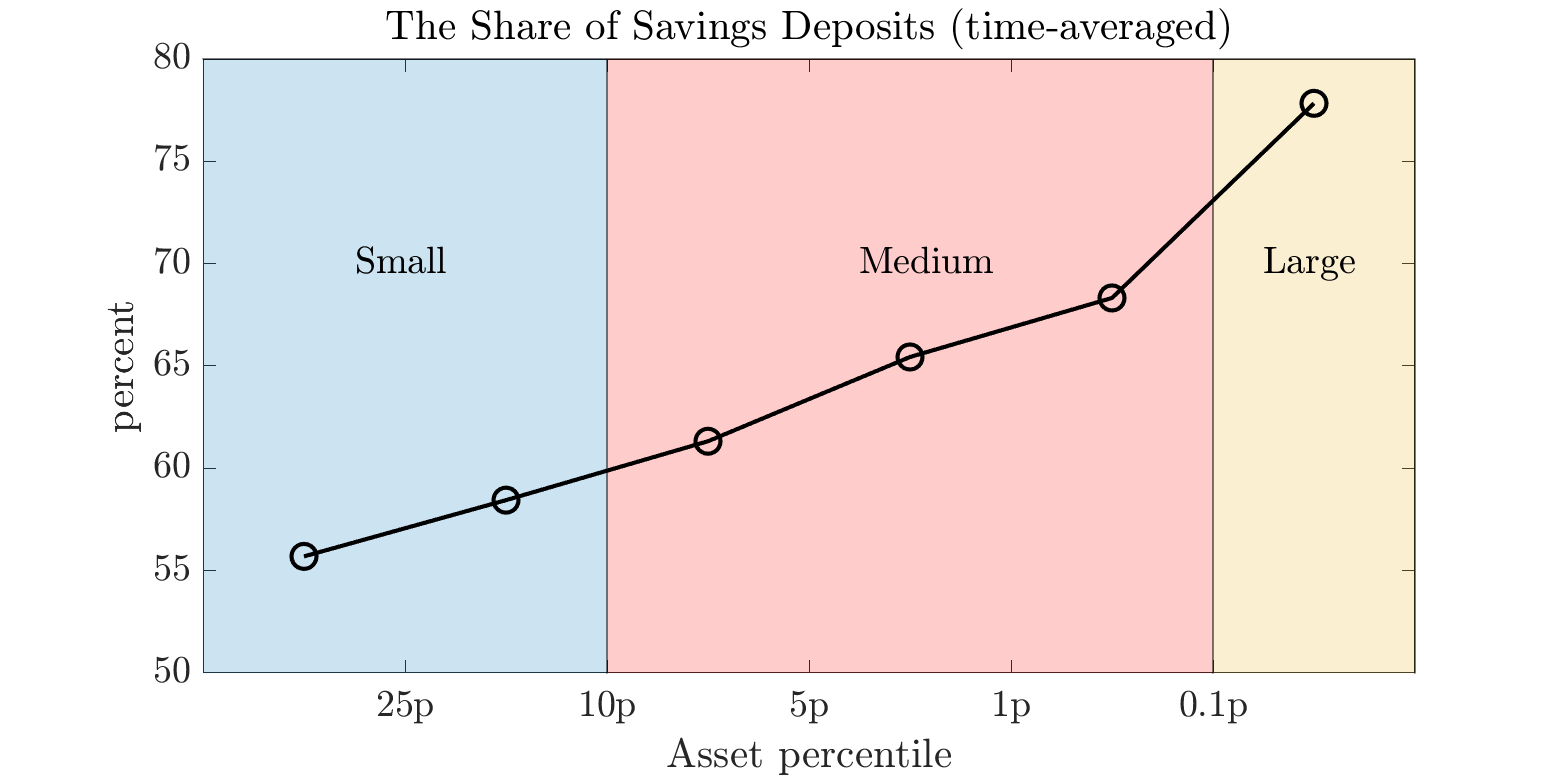

This paper examines the implications of banks' deposit mix and liquidity risk across the bank size

distribution for financial stability and macro-prudential policy. U.S. banks mix savings and time deposits,

with the share of savings deposits increasing in bank size. I incorporate this in a macroeconomic model of

banking industry dynamics, where heterogeneous banks choose their deposit mix and asset portfolio under

withdrawal risk in savings deposits. Repayment of withdrawals incentivizes banks to hold securities. Costly

time deposits protect against withdrawals and enable banks to substitute loans for securities. Withdrawal

risk varies by bank size, explaining the balance sheet composition of assets and deposits, as observed in

data. A higher share of savings deposits coming from the low withdrawal risk reduces the average funding

cost, expands the banking sector, and increases loans and output in the steady state but raises short-term

financial instability. When liquidity requirements are introduced, large banks are the most responsive; they

increase demand for securities and cut loan supply, leading to an unintended output cost associated with a

less concentrated banking sector in the long run.

This paper examines the implications of banks' deposit mix and liquidity risk across the bank size

distribution for financial stability and macro-prudential policy. U.S. banks mix savings and time deposits,

with the share of savings deposits increasing in bank size. I incorporate this in a macroeconomic model of

banking industry dynamics, where heterogeneous banks choose their deposit mix and asset portfolio under

withdrawal risk in savings deposits. Repayment of withdrawals incentivizes banks to hold securities. Costly

time deposits protect against withdrawals and enable banks to substitute loans for securities. Withdrawal

risk varies by bank size, explaining the balance sheet composition of assets and deposits, as observed in

data. A higher share of savings deposits coming from the low withdrawal risk reduces the average funding

cost, expands the banking sector, and increases loans and output in the steady state but raises short-term

financial instability. When liquidity requirements are introduced, large banks are the most responsive; they

increase demand for securities and cut loan supply, leading to an unintended output cost associated with a

less concentrated banking sector in the long run.

This paper examines the implications of banks' deposit mix and liquidity risk across the bank size

distribution for financial stability and macro-prudential policy. U.S. banks mix savings and time deposits,

with the share of savings deposits increasing in bank size. I incorporate this in a macroeconomic model of

banking industry dynamics, where heterogeneous banks choose their deposit mix and asset portfolio under

withdrawal risk in savings deposits. Repayment of withdrawals incentivizes banks to hold securities. Costly

time deposits protect against withdrawals and enable banks to substitute loans for securities. Withdrawal

risk varies by bank size, explaining the balance sheet composition of assets and deposits, as observed in

data. A higher share of savings deposits coming from the low withdrawal risk reduces the average funding

cost, expands the banking sector, and increases loans and output in the steady state but raises short-term

financial instability. When liquidity requirements are introduced, large banks are the most responsive; they

increase demand for securities and cut loan supply, leading to an unintended output cost associated with a

less concentrated banking sector in the long run.

This paper examines the implications of banks' deposit mix and liquidity risk across the bank size

distribution for financial stability and macro-prudential policy. U.S. banks mix savings and time deposits,

with the share of savings deposits increasing in bank size. I incorporate this in a macroeconomic model of

banking industry dynamics, where heterogeneous banks choose their deposit mix and asset portfolio under

withdrawal risk in savings deposits. Repayment of withdrawals incentivizes banks to hold securities. Costly

time deposits protect against withdrawals and enable banks to substitute loans for securities. Withdrawal

risk varies by bank size, explaining the balance sheet composition of assets and deposits, as observed in

data. A higher share of savings deposits coming from the low withdrawal risk reduces the average funding

cost, expands the banking sector, and increases loans and output in the steady state but raises short-term

financial instability. When liquidity requirements are introduced, large banks are the most responsive; they

increase demand for securities and cut loan supply, leading to an unintended output cost associated with a

less concentrated banking sector in the long run.

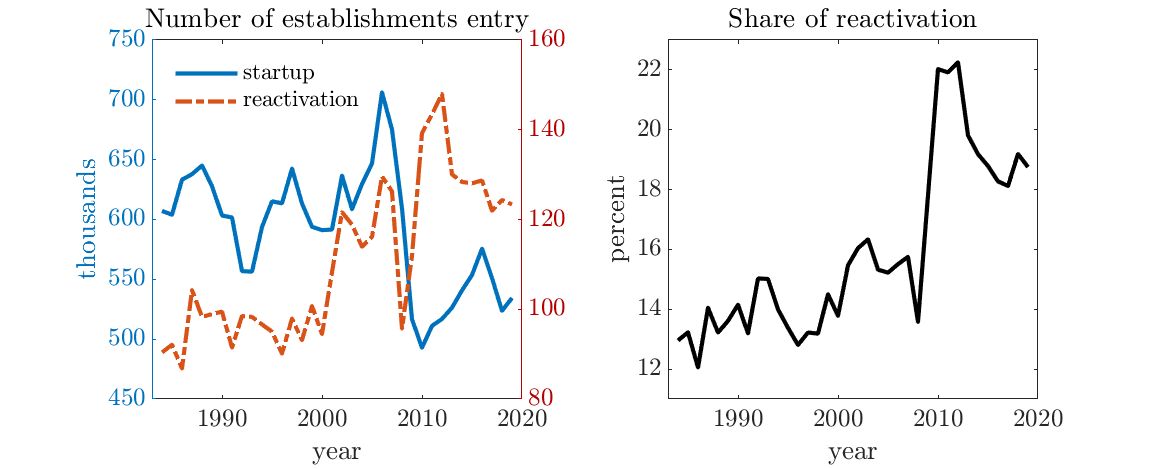

This paper examines the macroeconomic impact of allowing production units to pause and reactivate their

operations. The ability to pause and resume leads to fewer active firms, which alters the productivity

distribution. The capital held by firms that choose to pause suggests a new source of capital misallocation.

I develop a dynamic stochastic general equilibrium model featuring heterogeneous firms that can temporarily

shutdown their operations. The number of reactivated units from temporary shutdowns is aligned with data

from U.S. establishments. In equilibrium, there are fewer active firms compared to a model that does not

incorporate this option. This change results in a decline in aggregate productivity and other aggregate

variables. The reduction in the number of active firms is the primary driver of the observed effects.

This paper examines the macroeconomic impact of allowing production units to pause and reactivate their

operations. The ability to pause and resume leads to fewer active firms, which alters the productivity

distribution. The capital held by firms that choose to pause suggests a new source of capital misallocation.

I develop a dynamic stochastic general equilibrium model featuring heterogeneous firms that can temporarily

shutdown their operations. The number of reactivated units from temporary shutdowns is aligned with data

from U.S. establishments. In equilibrium, there are fewer active firms compared to a model that does not

incorporate this option. This change results in a decline in aggregate productivity and other aggregate

variables. The reduction in the number of active firms is the primary driver of the observed effects.