previously circulated with title "Bank Deposit Mix and Aggregate Implications for Financial Stability".

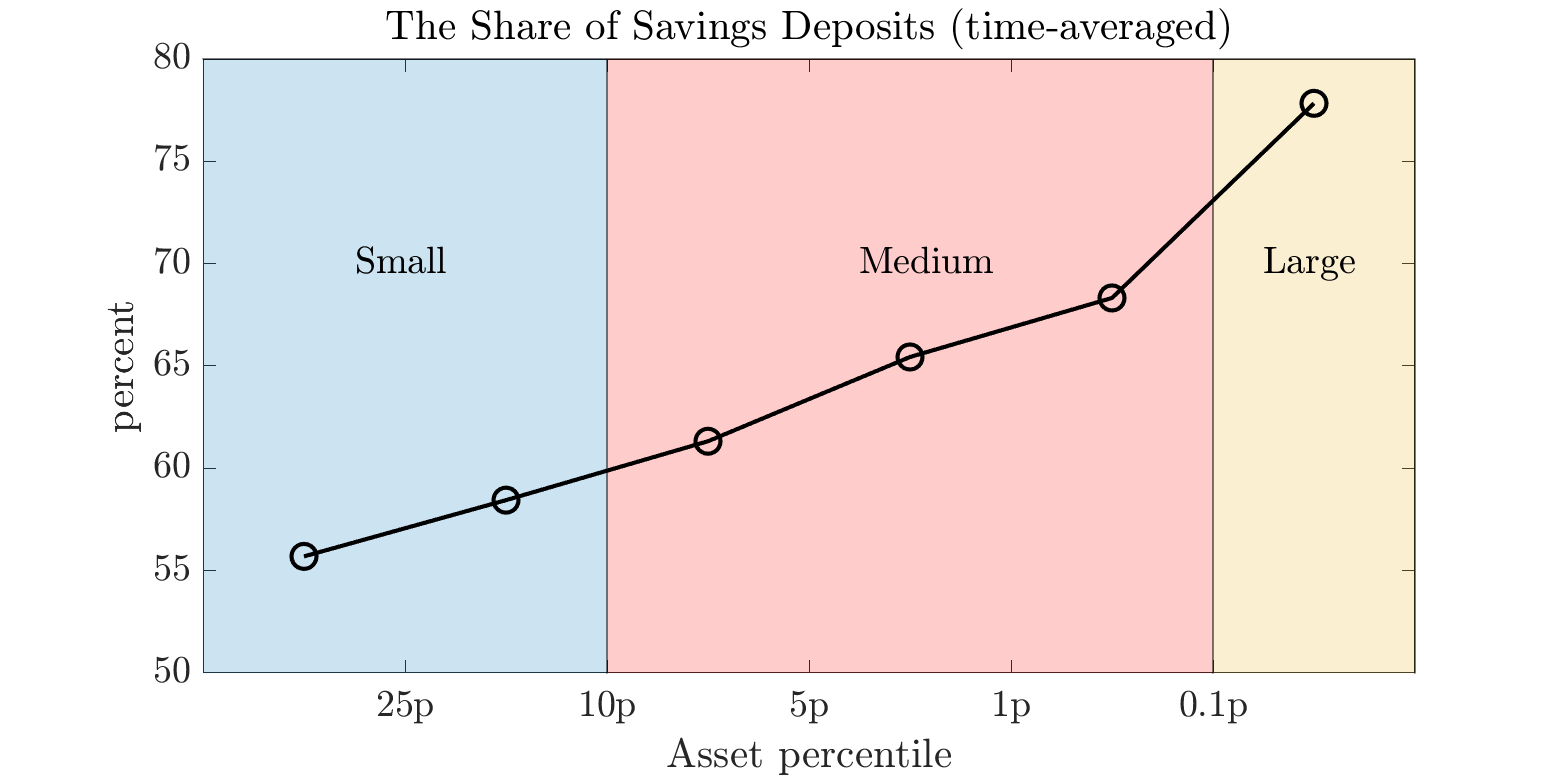

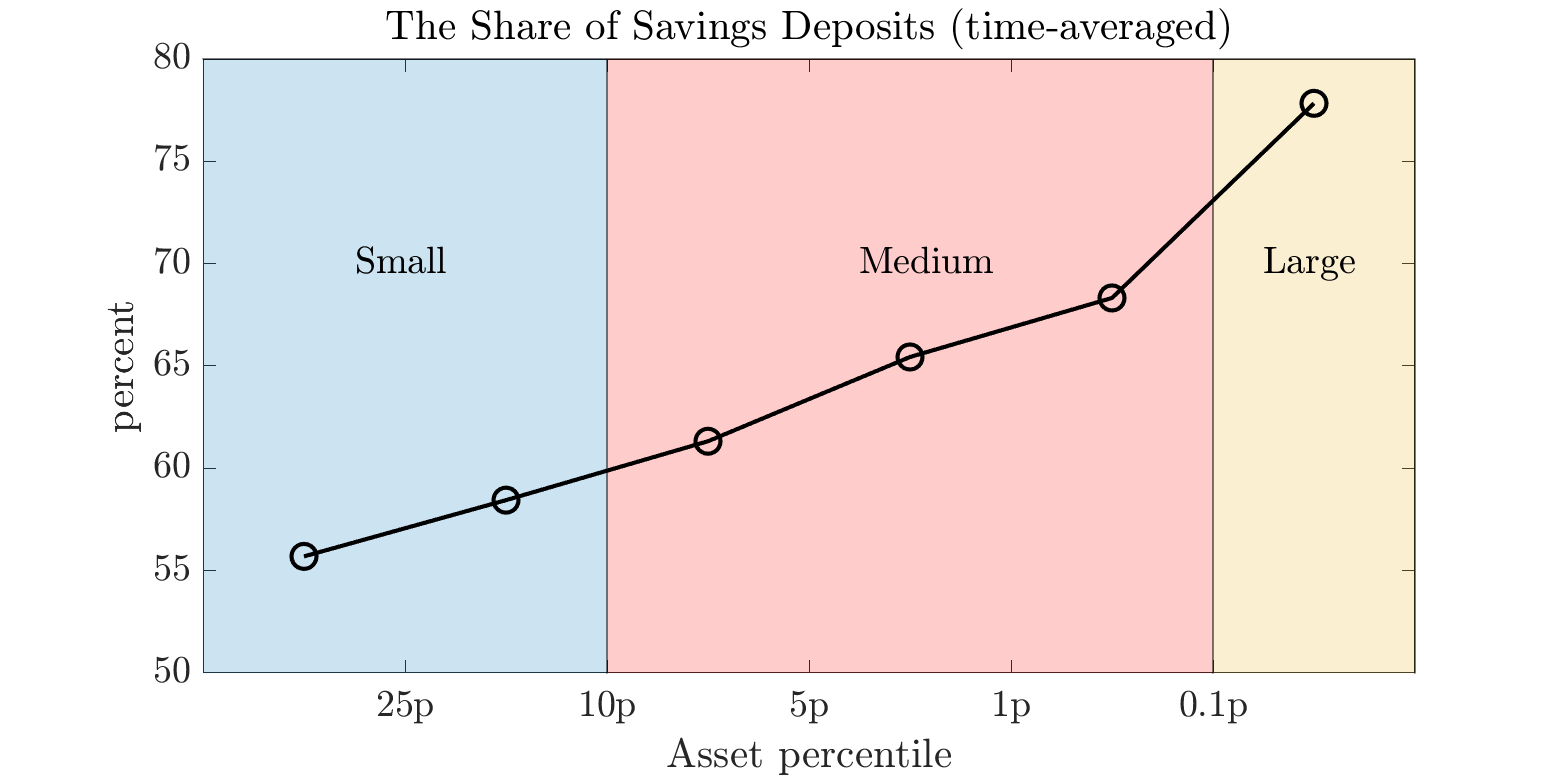

Large banks rely predominantly on liquid deposits despite their exposure to withdrawal risk. Using U.S. Call Report data, I document a pronounced size gradient in deposit composition and flow volatility: large banks allocate more than 80 percent of deposits to liquid instruments yet experience substantially lower and less volatile outflows than small banks. To quantify the aggregate implications of heterogeneous withdrawal risk, I develop a general equilibrium model in which banks optimally choose deposit mix and liquidity buffers under stochastic withdrawals. Withdrawal shocks trigger mid-period asset liquidation, linking funding structure to bank capital dynamics and equilibrium credit supply. Heterogeneity expands credit in normal times but amplifies downturns. Granting large banks more stable funding increases steady-state lending; equalizing withdrawal risk reduces aggregate loans by 1 percent and output by 0.7 percent. However, because large banks operate with thinner liquidity buffers, adverse shocks force costly balance sheet adjustment toward stable funding and liquid assets, raising funding costs and crowding out loans. Output contractions are 60 percent larger than in an economy with uniform withdrawal risk. A Basel III-style liquidity requirement halves capital losses during withdrawal shocks but reduces steady-state loans by 4 percent and output by 3 percent.

Large banks rely predominantly on liquid deposits despite their exposure to withdrawal risk. Using U.S. Call Report data, I document a pronounced size gradient in deposit composition and flow volatility: large banks allocate more than 80 percent of deposits to liquid instruments yet experience substantially lower and less volatile outflows than small banks. To quantify the aggregate implications of heterogeneous withdrawal risk, I develop a general equilibrium model in which banks optimally choose deposit mix and liquidity buffers under stochastic withdrawals. Withdrawal shocks trigger mid-period asset liquidation, linking funding structure to bank capital dynamics and equilibrium credit supply. Heterogeneity expands credit in normal times but amplifies downturns. Granting large banks more stable funding increases steady-state lending; equalizing withdrawal risk reduces aggregate loans by 1 percent and output by 0.7 percent. However, because large banks operate with thinner liquidity buffers, adverse shocks force costly balance sheet adjustment toward stable funding and liquid assets, raising funding costs and crowding out loans. Output contractions are 60 percent larger than in an economy with uniform withdrawal risk. A Basel III-style liquidity requirement halves capital losses during withdrawal shocks but reduces steady-state loans by 4 percent and output by 3 percent.

Large banks rely predominantly on liquid deposits despite their exposure to withdrawal risk. Using U.S. Call Report data, I document a pronounced size gradient in deposit composition and flow volatility: large banks allocate more than 80 percent of deposits to liquid instruments yet experience substantially lower and less volatile outflows than small banks. To quantify the aggregate implications of heterogeneous withdrawal risk, I develop a general equilibrium model in which banks optimally choose deposit mix and liquidity buffers under stochastic withdrawals. Withdrawal shocks trigger mid-period asset liquidation, linking funding structure to bank capital dynamics and equilibrium credit supply. Heterogeneity expands credit in normal times but amplifies downturns. Granting large banks more stable funding increases steady-state lending; equalizing withdrawal risk reduces aggregate loans by 1 percent and output by 0.7 percent. However, because large banks operate with thinner liquidity buffers, adverse shocks force costly balance sheet adjustment toward stable funding and liquid assets, raising funding costs and crowding out loans. Output contractions are 60 percent larger than in an economy with uniform withdrawal risk. A Basel III-style liquidity requirement halves capital losses during withdrawal shocks but reduces steady-state loans by 4 percent and output by 3 percent.

Large banks rely predominantly on liquid deposits despite their exposure to withdrawal risk. Using U.S. Call Report data, I document a pronounced size gradient in deposit composition and flow volatility: large banks allocate more than 80 percent of deposits to liquid instruments yet experience substantially lower and less volatile outflows than small banks. To quantify the aggregate implications of heterogeneous withdrawal risk, I develop a general equilibrium model in which banks optimally choose deposit mix and liquidity buffers under stochastic withdrawals. Withdrawal shocks trigger mid-period asset liquidation, linking funding structure to bank capital dynamics and equilibrium credit supply. Heterogeneity expands credit in normal times but amplifies downturns. Granting large banks more stable funding increases steady-state lending; equalizing withdrawal risk reduces aggregate loans by 1 percent and output by 0.7 percent. However, because large banks operate with thinner liquidity buffers, adverse shocks force costly balance sheet adjustment toward stable funding and liquid assets, raising funding costs and crowding out loans. Output contractions are 60 percent larger than in an economy with uniform withdrawal risk. A Basel III-style liquidity requirement halves capital losses during withdrawal shocks but reduces steady-state loans by 4 percent and output by 3 percent.

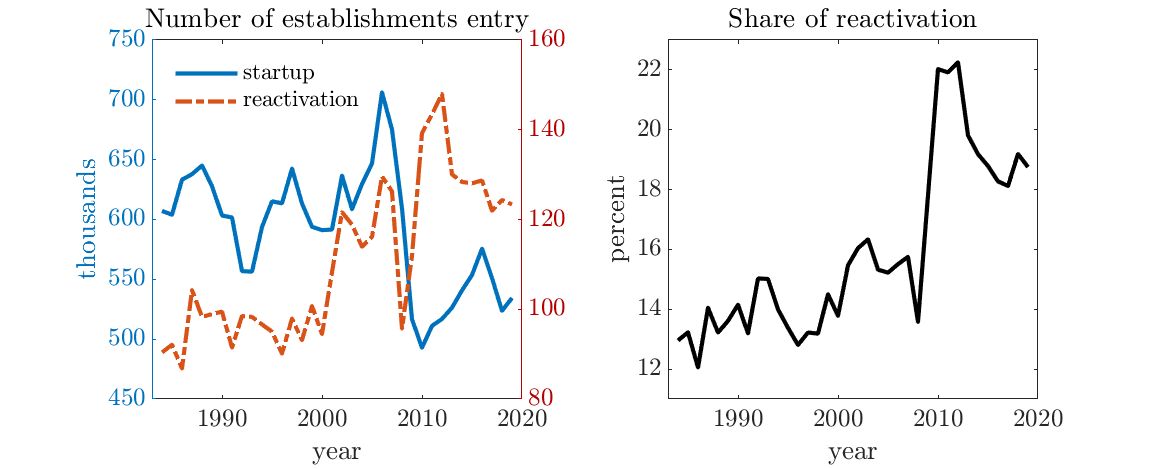

This paper examines the macroeconomic impact of allowing production units to pause and reactivate their

operations. The ability to pause and resume leads to fewer active firms, which alters the productivity

distribution. The capital held by firms that choose to pause suggests a new source of capital misallocation.

I develop a dynamic stochastic general equilibrium model featuring heterogeneous firms that can temporarily

shut down their operations. The number of reactivated units from temporary shutdowns is aligned with data

from U.S. establishments. In equilibrium, there are fewer active firms compared to a model that does not

incorporate this option. This change results in a decline in aggregate productivity and other aggregate

variables. The reduction in the number of active firms is the primary driver of the observed effects.

This paper examines the macroeconomic impact of allowing production units to pause and reactivate their

operations. The ability to pause and resume leads to fewer active firms, which alters the productivity

distribution. The capital held by firms that choose to pause suggests a new source of capital misallocation.

I develop a dynamic stochastic general equilibrium model featuring heterogeneous firms that can temporarily

shut down their operations. The number of reactivated units from temporary shutdowns is aligned with data

from U.S. establishments. In equilibrium, there are fewer active firms compared to a model that does not

incorporate this option. This change results in a decline in aggregate productivity and other aggregate

variables. The reduction in the number of active firms is the primary driver of the observed effects.